The Biden/Harris Administration to impose a college loan forgiveness plan sparks debate

Biden-Harris Administration proposes a new three-part college loan forgiveness plan

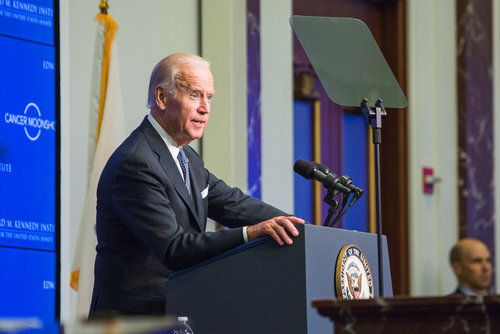

Because of the economic challenges created by the worldwide pandemic, the Biden-Harris Administration has continuously extended the student loan repayment pause a number of times. Because of this, no one with a federally held loan has had to pay a single dollar in loan payments since President Biden took office.

To ensure a smooth transition to repayment and prevent unnecessary defaults, the administration is extending the pause a final time through December 31, 2022, with payments resuming January of 2023. Furthermore, The Biden-Harris Administration has proposed a three part College Loan forgiveness plan to provide families breathing room as they prepare to start repaying loans after the economic crisis brought on by the pandemic and the Ukrainian war with Russia that continues to affect inflation.

If you’re wondering about eligibility, if you received a Pell Grant in college and meet the income threshold (your annual income must have fallen below $125,000 (for individuals) or $250,000 (for married couples or heads of households), you will be eligible for up to $20,000 in debt relief.

This basically just means relief is capped at the amount of your outstanding debt. For example: If you are eligible for $20,000, but have a balance of $15,000 remaining, you will only receive $15,000 in relief.

Income-based repayment plans have long existed within the U.S. Department of Education. This time however, the Biden-Harris Administration is proposing a rule to create a new income-driven repayment plan that will substantially reduce future monthly payments for lower- and middle-income borrowers.

In order to do this, they would raise the amount of income that’s considered non-discretionary income (protected from repayment) in order to guarantee that no borrower earning under 225% of the federal poverty level (about the annual equivalent of a $15 minimum wage for a single borrower) will have to make a monthly payment.

Unlike previous plans, they would plan to cover the borrower’s unpaid monthly interest, so that no borrower’s loan balance will grow as long as they make their monthly payments—even when that monthly payment is $0 because their income is low.

There are some problems that arise with this plan though.

First of all, it can be a huge cost to taxpayers. Canceled student debt can be considered taxable income. Although borrowers won’t be required to pay federal taxes on their canceled student debt, some states may charge levies on the relief.

This has caused some legal challenges as people have argued its unconstitutionality. The administration has maintained that the president has the authority to cancel student debt, but many critics have contested that with six Republican-led states filing a lawsuit to block Biden’s action with an argument by GOP state officials that the president doesn’t have the power to issue nationwide debt relief without Congress. They’re also claiming that the policy would harm private companies that service some federal student loans by reducing their business.

The debate is often framed as a choice between a universal or a targeted policy approach. Advocates of targeted approaches suggest that universal approaches tend to be unjust, because they offer benefits to people who don’t necessarily need them, and it can be unfair as these breaks do not apply to previous debt holders who already paid off their student loans, which is a big argument for the oppositions side to stop this plan.

While the universal approach often focuses on the dollar amount of debt forgiven and the targeted approach often focuses on the income threshold for who would qualify for debt forgiveness, an approach forgiving a proportion of loans should be considered as an option as well.

This way, policies could take into account the actual amount of individuals’ debt and forgive a certain proportion of it. This strategy could be applied to either universal or targeted debt forgiveness, or a combination of both approaches.

For example, everyone could have a proportion of their student debt forgiven, and this proportion could increase specifically for lower-income individuals. This approach would have the benefit of addressing the equity concerns of those advocating for a more targeted approach, while still providing real and substantial benefits to student debt holders across the income spectrum.

The most important part of this, at least for our generation, is part 3 of the plan, to make the student loan system more manageable for current and future borrowers.

Through all of this debate, my takeaway is our need to change the way student loans work and their affordability. This has long been an issue as year by year, colleges raise their tuition, housing, really anything you can name.

With this plan, hopefully relief will be extended to the former generation of students and in the future we can change our system to eradicate such a need for this plan in the first place. Until then, this is what we have to work with.